Synergies and The Path Forward

The cross-section between DePIN, RWA tokenization, and the vision of Bitcoin reveals an ecosystem that could be a logical successor to the traditional and legacy systems currently in operation. As is often the case in systems, it is built on concepts that reinforce one another:

- DePIN introduces a scalable way to deploy and operate real-world infrastructure using token-based incentives. With over 13 million daily contribution devices and more than $500 million in annual revenue as of last year.

- RWA tokenization brings liquidity, access, and composability to real-world value. This years forecasts estimate $50 billion in assets on-chain by the end of 2025, including innovative assets like private credit, real estate, and commodities. With the rise of compliant frameworks and standards like ERC-3643, At Defactor, we’ve been quietly building in this space for years, refining and perfecting our modular tokenization toolkit to meet the needs of a rapidly evolving ecosystem. Our focus has always been on creating tools that bridge traditional systems with decentralized innovation, staying true to the original vision of Bitcoin: empowering individuals, reducing reliance on intermediaries, and unlocking new models of trust and ownership.

- At its very core, Bitcoin reframes how we define value and trust. It introduced a world where ownership can exist without custodians, where consensus emerges without central arbiters, and where economic systems are governed by code rather than institutions. Widespread institutional use may mark its entry into the halls of TradFi, but Bitcoin’s real legacy is ideological: it remains a guiding principle for building systems that are open by default, ownerless by design, and resilient through decentralization. In this convergence, Bitcoin is the first domino to fall. As the saying goes, “there’s no river long enough that it doesn’t bend”, and blockchain’s path may curve still through regulation, adoption, and reinterpretation. In its current form it still carries the same uncompromising vision of a decentralized future.

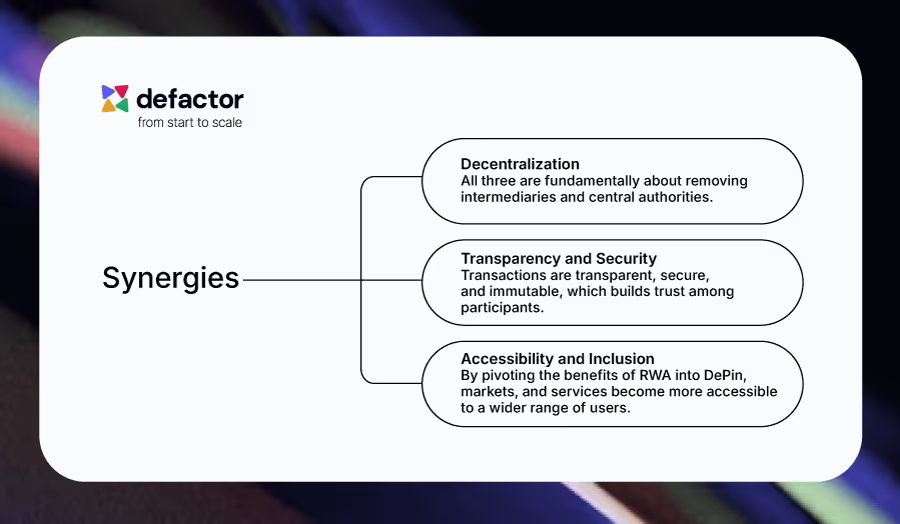

These are mutually reinforcing principles. As DePIN grounds decentralized systems in real-world infrastructure, RWA tokenization layers on liquidity and ownership, while Bitcoin lends the ideological coherence to build without central control. Together, they form a cycle: decentralization drives transparency, transparency builds trust, and trust unlocks broader access and inclusion:

Challenges Ahead

As is expected with any major infrastructure, decentralized or not, the high initial cost of setup will be an issue, as it requires substantial investment in technology, equipment, and resources. However, as the infrastructure in many nations is beginning to crack and creak or, in some cases, is clearly crumbling, one could argue that DePIN may have arrived at an opportune moment. Additionally, technical complexity poses a barrier, as the successful implementation of DePIN requires expertise in blockchain, networking, and cybersecurity, which may not be readily available in every market. Regulatory challenges will also be critical as a DePIN network would likely need to operate across multiple jurisdictions. Inconsistencies, incompatibilities, and simple but drastic imbalances in wealth (and therefore infrastructure) may exist even in countries that share borders, creating a complex regulatory landscape. That said, the emergence of standardized toolkits, middleware platforms, and open DePIN protocols is lowering the threshold for new entrants. Another concern is scalability, as maintaining performance and security across a distributed network with potentially millions of participants can be technologically demanding. Lastly, user adoption is crucial; DePIN must overcome the reluctance of users accustomed to traditional, centralized systems and may be hesitant to trust or engage with decentralized alternatives, which proves to be the largest hurdle for successfully navigating mass adoption. However, as with RWA tokenization, the narrative is shifting as access expands, interfaces improve, and real-world use cases prove their value.

Key Takeaways

- DePIN, RWA tokenization, and Bitcoin form a shared vision for a decentralized, interoperable future addressing infrastructure, ownership, and trust

- Together, they point to a more transparent, accessible, and inclusive global system, challenging the centralized models that have historically governed finance and infastructure

- Bitcoin’s original ethos has transcended digital currency, becoming a foundational idea that informs decentralized coordination

- This convergence is unfolding through real deployments, institutional adoption, and maturing frameworks that anchor the promise of Web3 in the physical world